VAT Rules

VAT Module

Basic tables, mandatory settings and fields.

New feature for automatic calculation of VAT on charges between DK, EU Countries and International/Third Countries has been released with Version 5.6.34 of Uniteam5 Silverlight.

The new VAT Module is designed for flexible use depending on the Country of installation.

Uniteam recommend users to contact local Country Authorities for details on legal requirements for the Country.

The following settings need to be setup by yourself.

1.

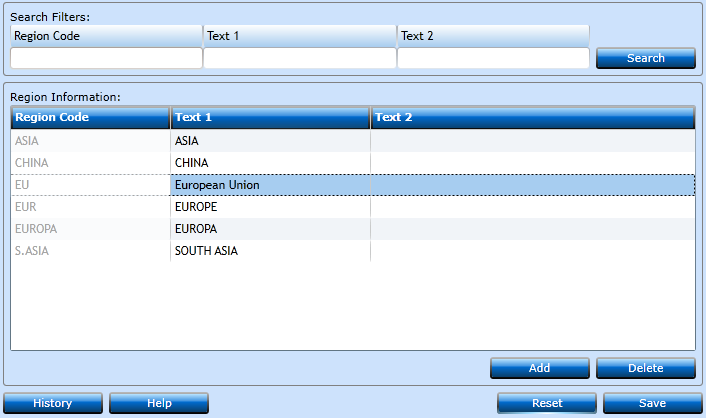

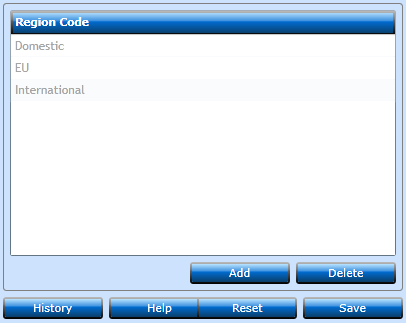

Region for European Union must be created and available in the Region table

Go to menu for Finance -> Administration -> Code Files -> Region Code

If Region Code EU do not exist, it must be added

2.

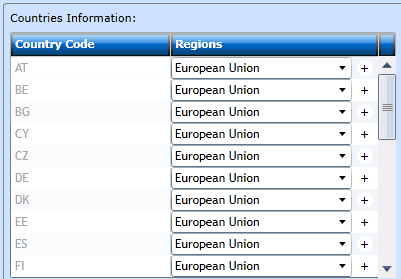

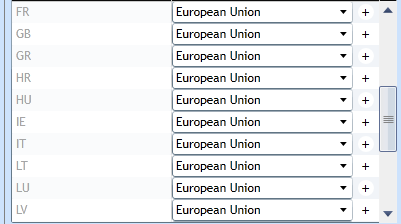

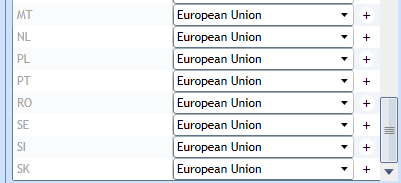

All European Countries must be linked to Region EU

Go to menu for Finance -> Administration -> Code Files -> Countries

Update all EU Country Codes to link to Region European Union with Code EU.

List below should be complete for EU Countries.

Exception: Country of UT5 installation must be ‘blank’ for EU – even if member of EU.

3.

Check VAT Region Codes.

Go to menu for Finance -> Administration -> Code Files -> VAT Region Codes

If Region Code EU does not exist, click Add and EU will appear.

Click Save

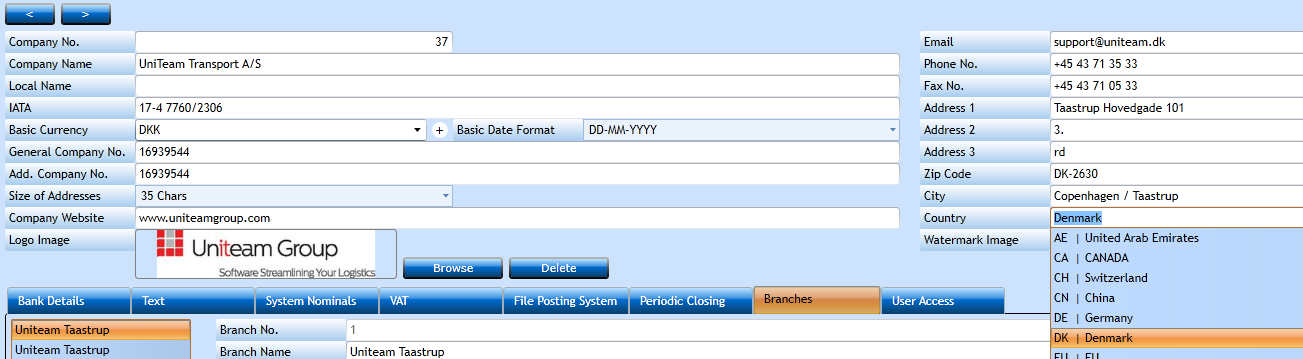

4.

In the Company File the controlling Company must be linked to the correct Country

Go to menu for Finance -> General -> Company

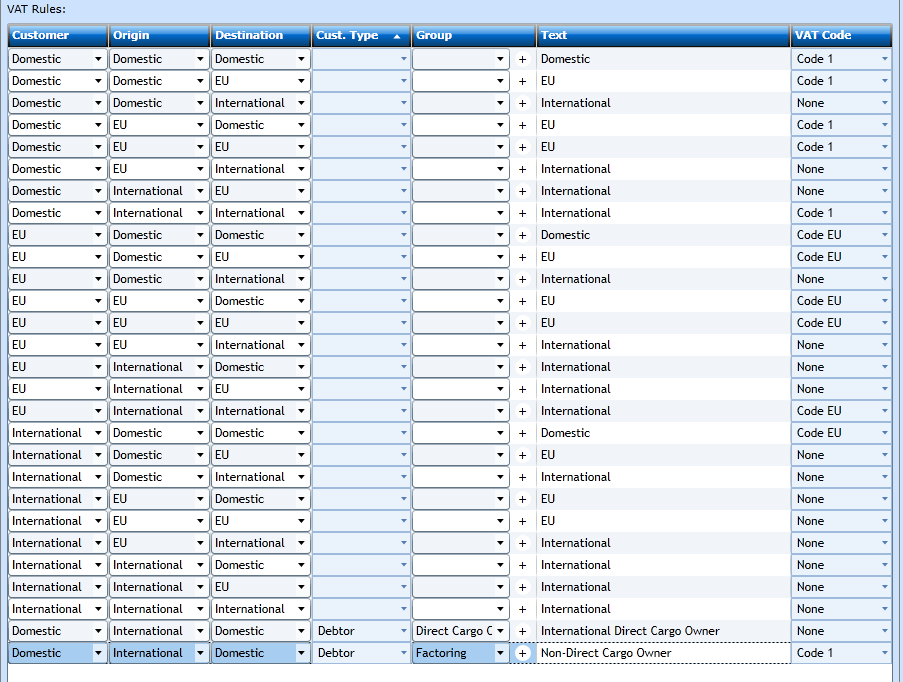

5.

The table for VAT Rules needs to be set up as below.

Below rules are valid for DK and are according to The Danish Freight Forwarders Association guidelines of July 2010 – news edition no. 29

Go to menu for Finance -> General -> VAT Rules

Customer: Invoice party – Customer in booking – as per Country in Customer File or invoice party to Invoice

Origin: Shipper in booking – as per Country in Customer File or as per address details

Destination: Consignee in booking – as per Country in Customer File or as per address details

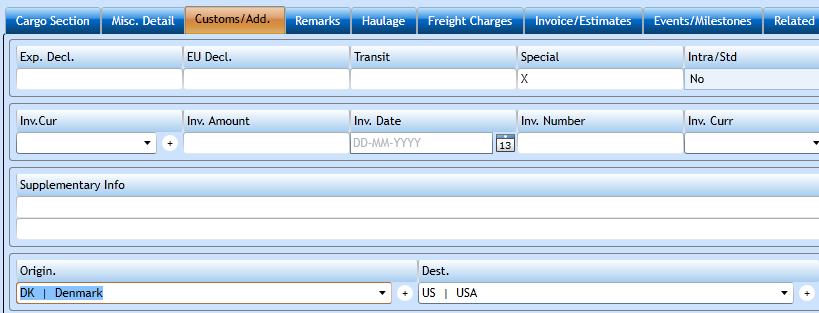

For Air, Ocean and Line modules, Origin and Destination countries (Shipper and Consignee) are also visible in the Customs / Add. tab in the bookings at the bottom.

For Road module it is Departure and Arrival Countries in the booking.

6.

All existing Charges need to be amended to be set to Auto for VAT Code

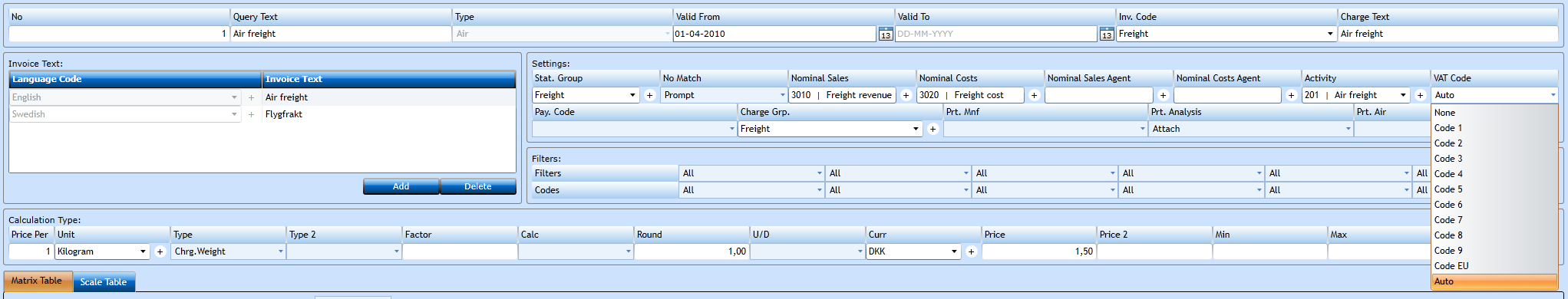

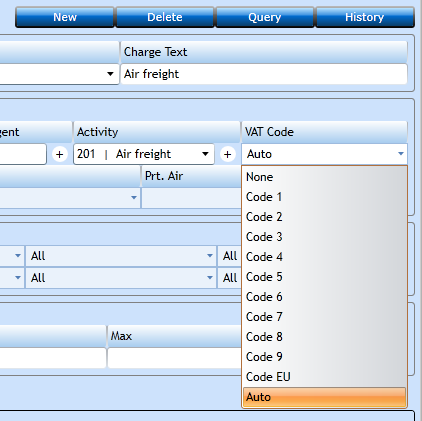

Go to menu for Finance -> General -> Charge

Select Auto for all charges that need to automatically calculate VAT against the new VAT Module rules

Remember to click Save

All charges for invoicing will now automatically calculate DK VAT as per legal Danish VAT rules for Domestic DK, EU and International/Third Countries.

Important notice:

It is important to contact local authorities to obtain applicable legal rules for the country to set-up.