User VAT report

Settings and Report for VAT

For VAT to work and perform according to the requirements of the authorities in your country and other countries, you need to setup a combination of VAT codes and nominals in UNITEAM.

SETTINGS:

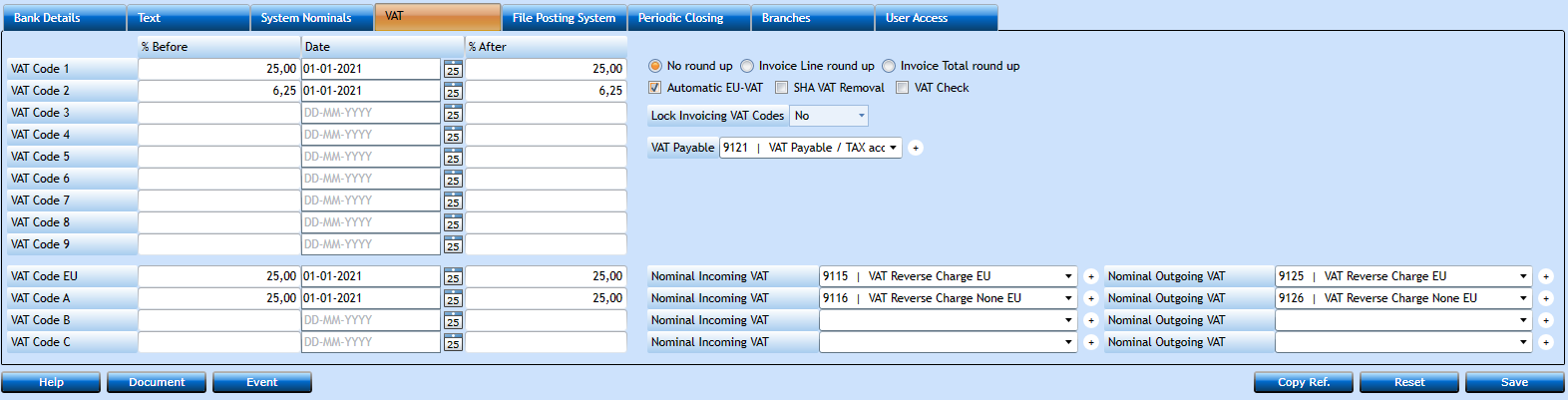

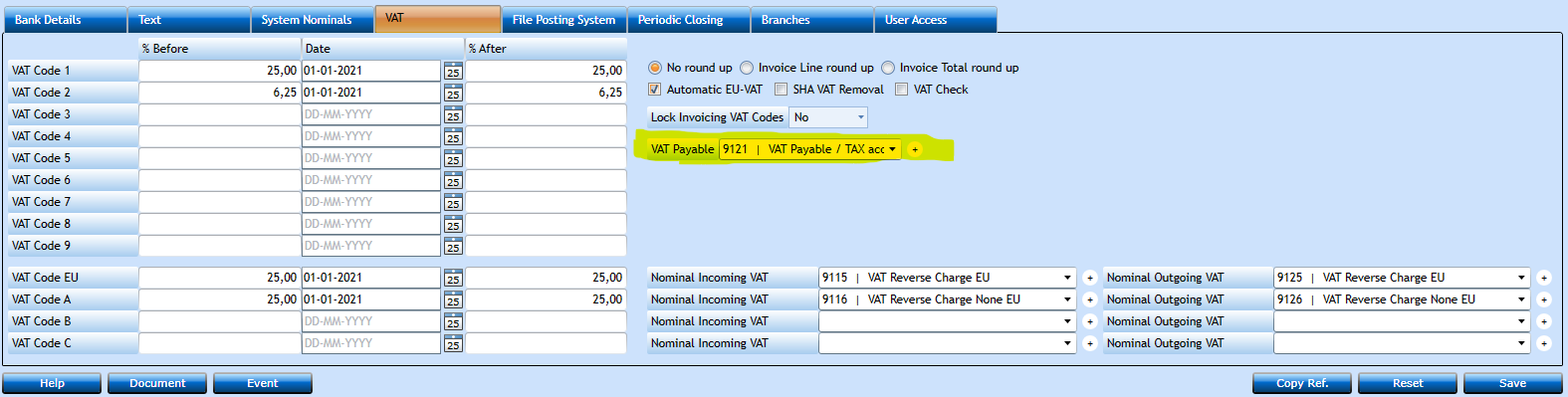

In the menu Finance / General / Company under the VAT tab you have 9 VAT codes, an EU VAT code, and 3 reverse charges A to C available. Nominals for the EU VAT code plus A to C reverse charges are setup here and nominals for the 9 VAT code is setup under the System Nominals tab.

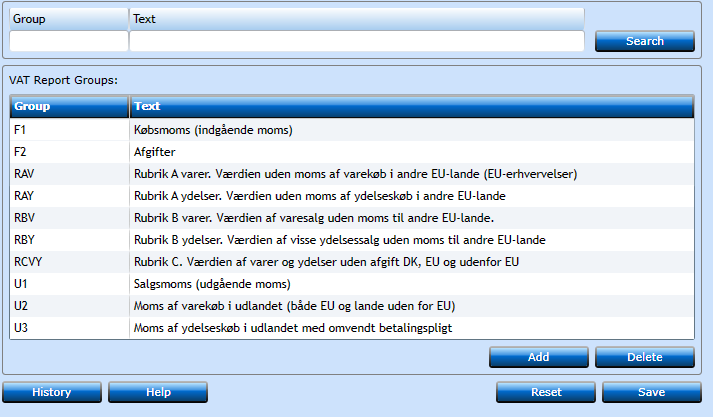

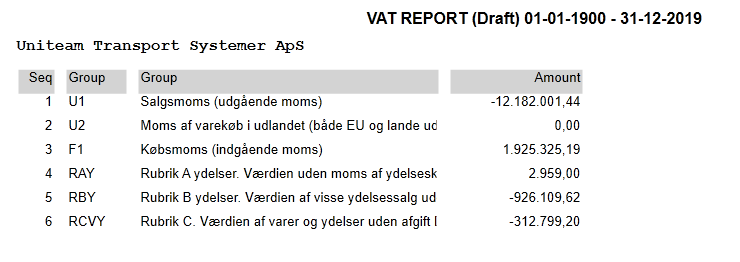

Under Finance / Administration / Code Files / VAT Report Groups you add a group for each line/amount in your TAX return report. (here is an example for Denmark)

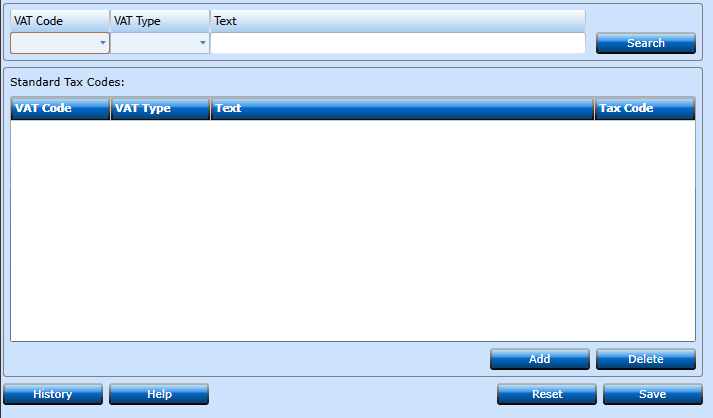

In Norway, there is requirements that the system's VAT codes must be mapped to the SAF-T standard VAT codes, for the SAF-T export of accounting data.

You do this here:

Finance / Administration / Code Files / Standard Tax Codes

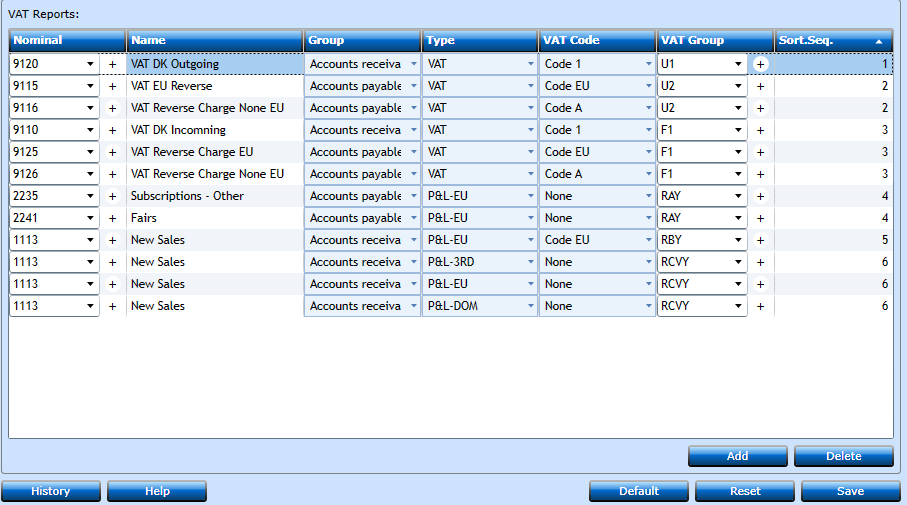

Next step is the coding of the VAT report, so it accommodates the requirements of your country’s Tax authorities. It is done under Finance / Posting / User VAT report

A combination of Nominal, AR/AP, P&L or VAT, VAT code and VAT group will enable you to ‘program’ each line to show the amount you require for your TAX Return report.

VAT groups are the ones you created under Finance / Administration / Code Files / VAT Report Groups.

Sort.Seq. determines the order in which the amounts are displayed in reports.

If you use the Default button, accounts from the System Nominals, VAT and File Posting System tabs in Company will be added to the list, and you can add the rest of the details.

REPORTS:

The reports can be printed under Finance / Reports / User VAT Report Print

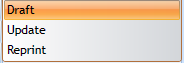

In the drop down under Function you have 3 options:

Start with the Draft option, and when all data is correct use Update, which will mark postings as reported and move balance from the VAT accounts to the VAT Payable account you set up under Finance / General / Company / VAT tab.

The Report Type will also give you 3 options:

Summary Report:

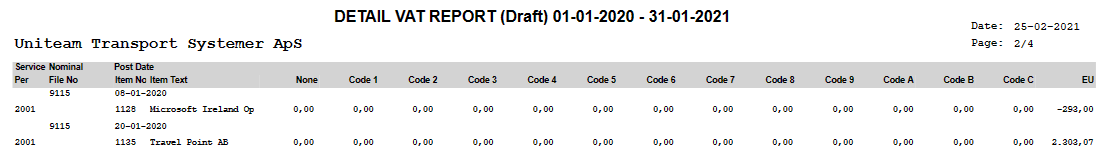

Detail Report:

OBS! The first time you run this report you want to run an update up until your last Tax Returns report. This will mark all the previous postings, that have already been reported to the Tax authorities, in order to exclude them in the present report.