Preliminary Invoice

Preliminary Invoice

In the Preliminary Invoice program you can insert all Vendor invoices once they arrive in the company. They will not be posted to the A/P, but in a table where you can Query them

if needed. In some cases you may need to check if the invoices have arrived, and using the Preliminary Invoice Registration ensure you know exactly that.

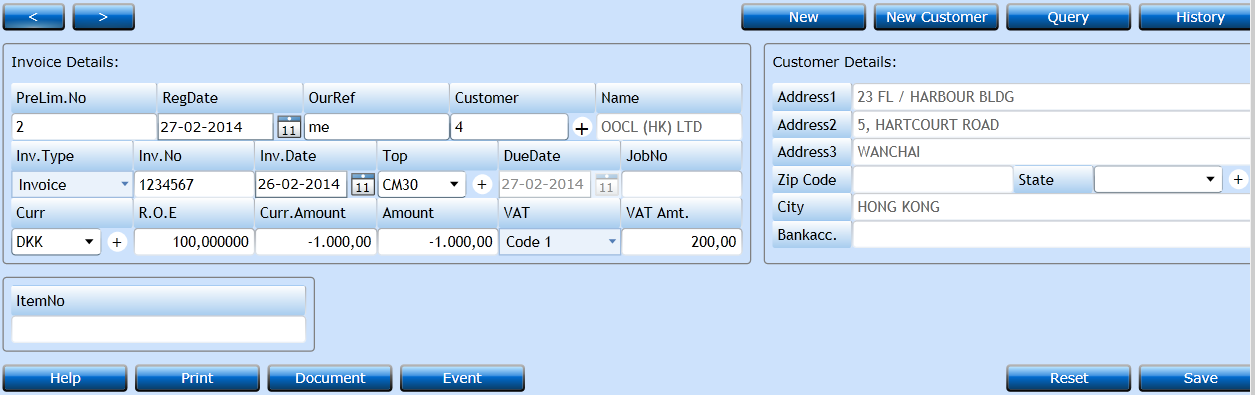

Press the New-button [F2] to insert a vendor invoice.

|

This number is assigned by the system and is a running Sequence from the Counters table. |

|

|

Default to Today's Date, but can be amended manually to the Date when the Invoice arrived. |

|

|

Defaults to the user logged in, but can be amended to the person who should approve the Invoice later. |

|

|

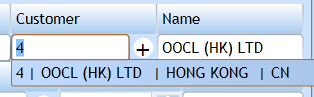

Insert the name of the Vendor issuing the Invoice. You can start typing the Name and a list of valid names will appear, or press the "+" to insert a new Vendor. Once inserted the address details will be shown in the right side of the screen under Customer Details. |

|

Indicate if this is an Invoice or a Credit Note. |

|

|

Insert the Invoice No. |

|

|

Defaults to Yesterday's Date, but can be amended to reflect the Invoice Date. |

|

|

Terms Of Payment will be inserted from the Customer File. You can amend selecting another value from the Code File Terms. |

|

|

The Due Date is calculated from the Invoice Date adding the days in TOP. |

|

|

Open field for inserting a manual reference. |

|

|

Will default to the value from the Customer File, but can be amended manually. |

|

|

R.O.E. |

The Rate of Exchange will default from the Currency File, but can be amended manually. |

|

Curr.Amount |

Insert the total amount (incl. VAT if applicable) in the Currency of the Invoice. |

|

Amount |

Based on the Currency and the Currency Amount the system will calculate the amount in Local Currency. You can amend this manually. |

|

Select the correct VAT Code. Default is set from the Customer File but you can choose any Code which has been defined in the Company File. |

|

|

VAT Amt. |

The VAT amount will be calculated based on the VAT Code chosen. Can be amended manually. |

When finished press Save [F8] or Reset to regret input.