FileRecon

File Reconciliation

Before the auditor approves the result, you may have to specify the figures on the nominals involved in the file postings. In general, we operate with 4 groups of nominals. Work in progress, closed work, income/costs and year end nominals.

Since the nominals for work in progress actually contain figures for open and finalized postings you need to print some reports to identify the actual work in progress.

If you are using Periodic Ending this File Reconciliation must be performed before closing Period 12

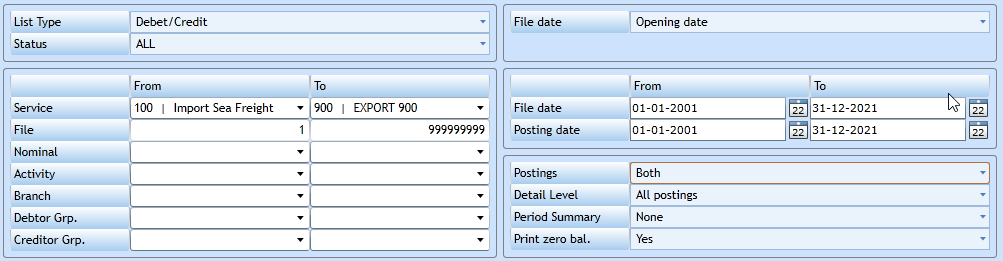

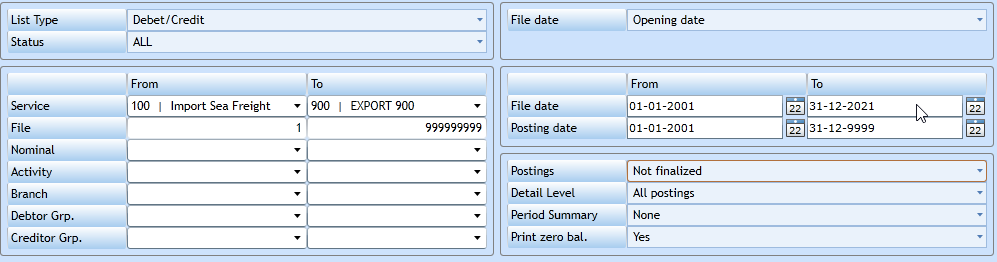

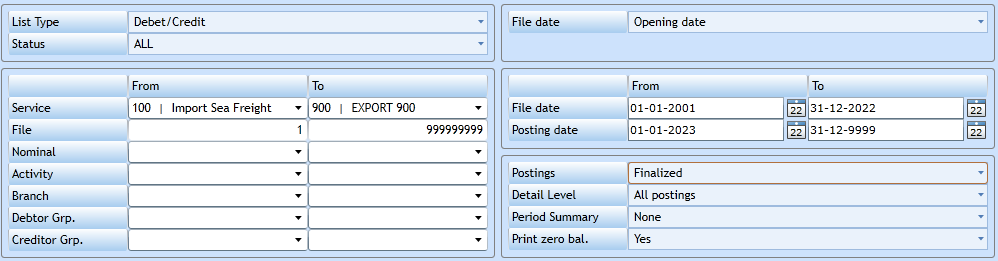

If you are going to reconcile 2022 you must make sure that no postings dated 2021 or before have status not finalized. Do the same for all files with opening date in 2021 or before. This you can do via the report “File List” with below settings:

This one will show all postings dated before 1st of January 2022, while the example below will show you all files with opening date before 1st of January 2022 where there are

postings not finalized.

IF ONE OF THESE LISTS GIVES A RESULT YOU HAVE TO FINALIZE THESE FILES BEFORE CONTINUING.

Now you are ready to do the reconciliation.

First of all, you print a balance report for the year – for instance 2200 – 2212. If you use standard finance report, you shall use the figures in the column named Balance in the right side of the report.

Then you must print the finance file list in three different ways.

List number 1:

Will show you all postings, dated in 2022 or before that are not finalized.

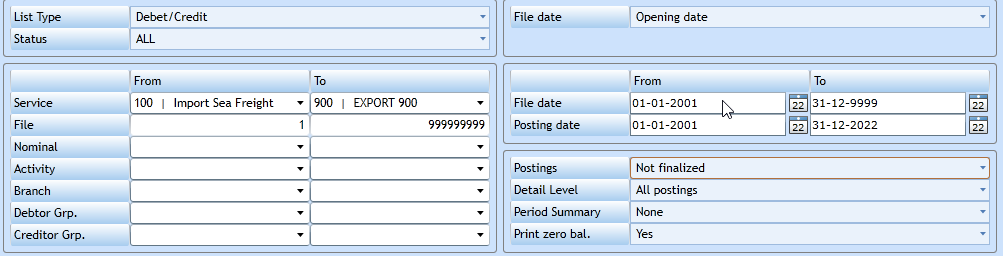

List number 2:

Will show you all finalized postings dated in 2022 but posted on files with opening date in 2023. This list is needed since the postings appear on the nominal for work in progress in 2022, but on the nominal for closed work in 2023.

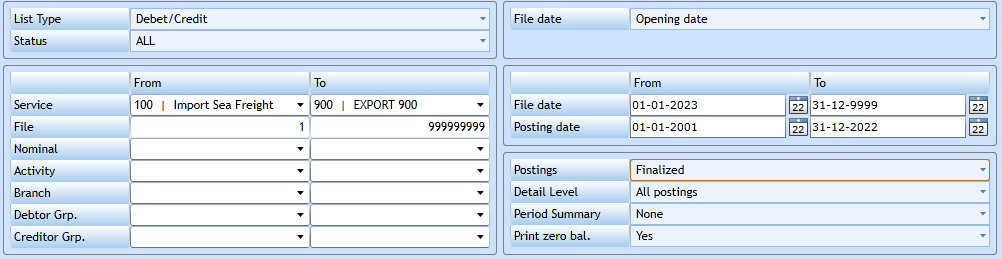

List number 3:

Will show the same as list number 2, but with opposite dates, showing finalized postings on nominals for work in progress 2023, but belonging to files with opening date in 2022.

Now you have the lists making you able to perform the reconciliation, and you can add all figures into excel following below formula.

File reconciliation formula

Nominals for work in progress (sales) from the balance report

+ Nominals for work in progress (Purchase) from the balance report

- Total of list number 1 note credit should have – in front

- Total of list number 2 note credit should have – in front

+ Total of list number 3 note credit should have – in front

Sum 1

Nominals for closed work (sales) from the balance report

+Nominals for closed work (purchase) from the balance report

Sum 2

Nominals for yearend adjustment from the balance report

Sum 3

Sum 1 + Sum 2 + Sum 3 = 0

If you are in the first year of posting into Uniteam and have not had the first yearend you will not make use of the last set on nominals

If the total is not 0 you must find the difference before performing the yearend. Otherwise the difference will be carried on to next year, and thus even harder to find. Possibilities for this difference could be:

- You still have open postings with date 2 years old.

- You have files created with an opening date out of the range in list number 1, but with postings dated in the year you reconcile.

- Postings on the nominal(s) for work in progress without service or file number can happen if you have removed a check in the nominal ledger for these nominal(s).

- Manual postings have been made to the nominal(s) for work in progress.

- All relevant nominal(s) are not included in Sum 2.

If none of these measures help, you may have to contact our support team for assistance.

A final thing to be sure that the result is correct will be to check that Sum 2 is the same figure that is reflected in the profit and loss report.