Amend Interest Reminder

Amend Interest Reminder

Reminder and Interest

Using this function, you will be able to send a reminder with reminder fee and interest invoice in the same invoices. You will be able to perform the calculation. Check if the calculation is correct and amend if necessary.

Print or mail the reminder/interest invoice and post same on a preliminary balance account. When the invoice is paid the system will move the amount form the balance nominal to a designated profit/loss nominal.

After posting but before payment it is possible to make a rollback if the customer will not pay. It is also possible to create reminders only. We will go through the procedure step by step.

Setup:

Before starting the calculation, you need to set up a few parameters in Finance. These are defining the nominal(s) for posting the interests, reminder fee and the nominal for the preliminary posting.

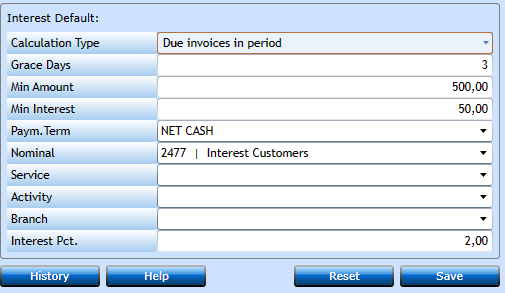

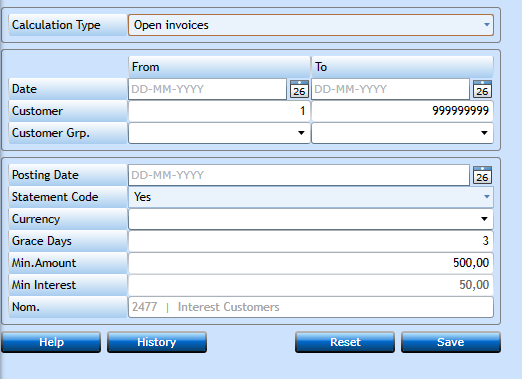

Posting of Interest: Finance / Closing / Interest Default

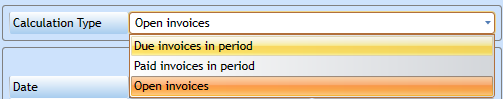

You can calculate interests in 2 ways. You can choose Due invoices in period or Paid invoices in period. The last option in the Calculation Type: Open invoices is not for interest calculation, but for reminders only.

Enter Grace Days. If you wish to have a minimum total amount for an invoice you can insert this in Min. Amount. Select terms of payment for the interest invoice and insert the nominal to which the interest income

shall be posted, when the invoice is paid. If the interest income should be posted onto a separate service, activity or branch you can insert the values.

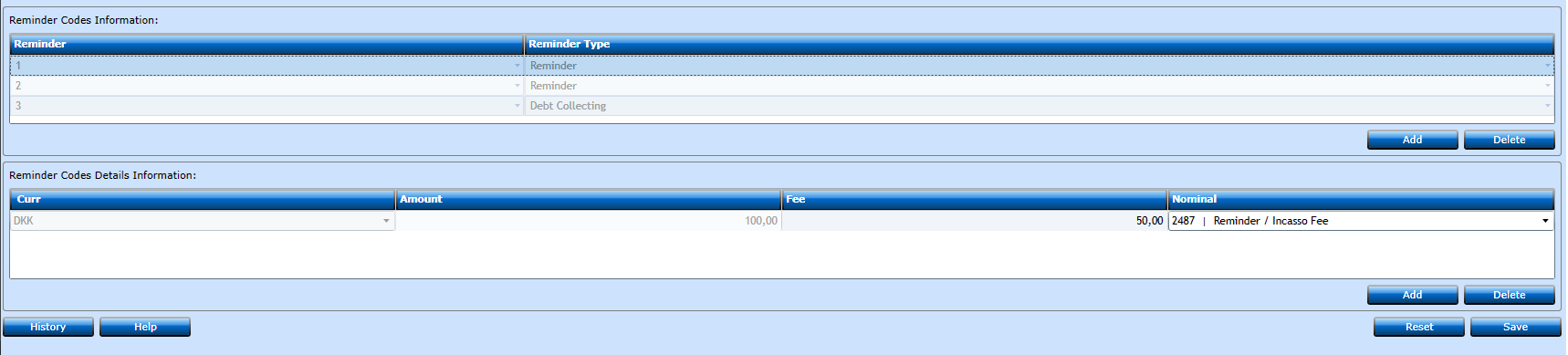

Reminder codes and fees: Finance / General / Reminder Code

You can create 4 reminder codes and a warning of Debt collecting. The last code will stop the invoice from being included in the reminders anymore.

Each code can have a separate fee and you can create fees in various amounts and currencies. The system will add the fee in the currency of the overdue invoices.

You can choose how many codes you wish to have included. In this case reminder code 1 is highlighted and the fees for reminder code 1 shown below.

To create these, mark the line with the reminder code number, press Add, and enter details for each currency.

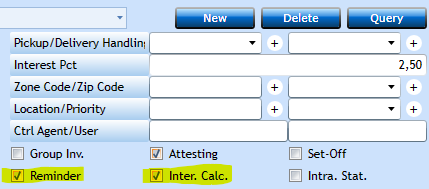

Customer: Finance / General / Customer File

Make sure your customers are marked for Reminder and Inter. Calc. (We recommend this to be setup on your Standard Customer (1)

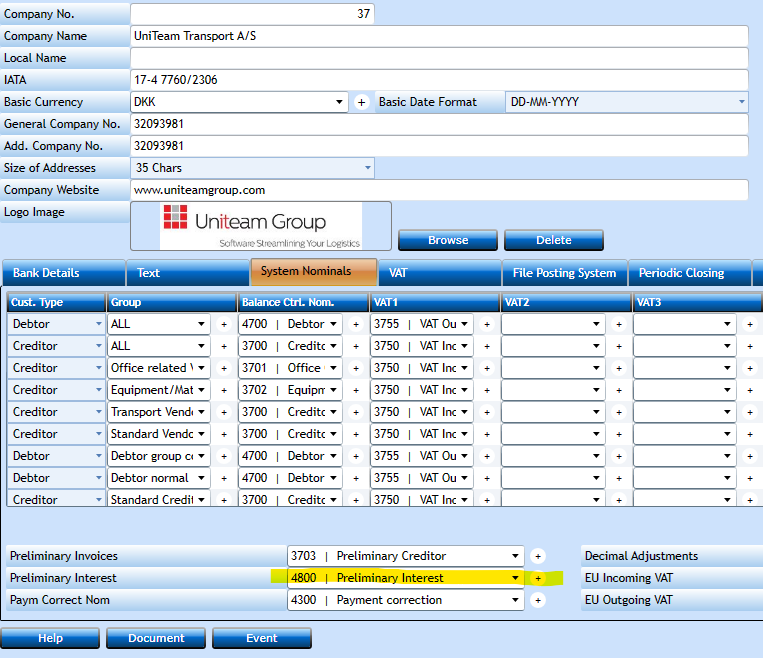

Company File: To let the system post the reminder fees and interest income into the balance, you need to define the nominal number to the system. This must be inserted in the company file which is accessed via the menu Finance / General / Company

Go to the System Nominals tab and insert into the Preliminary Interest field.

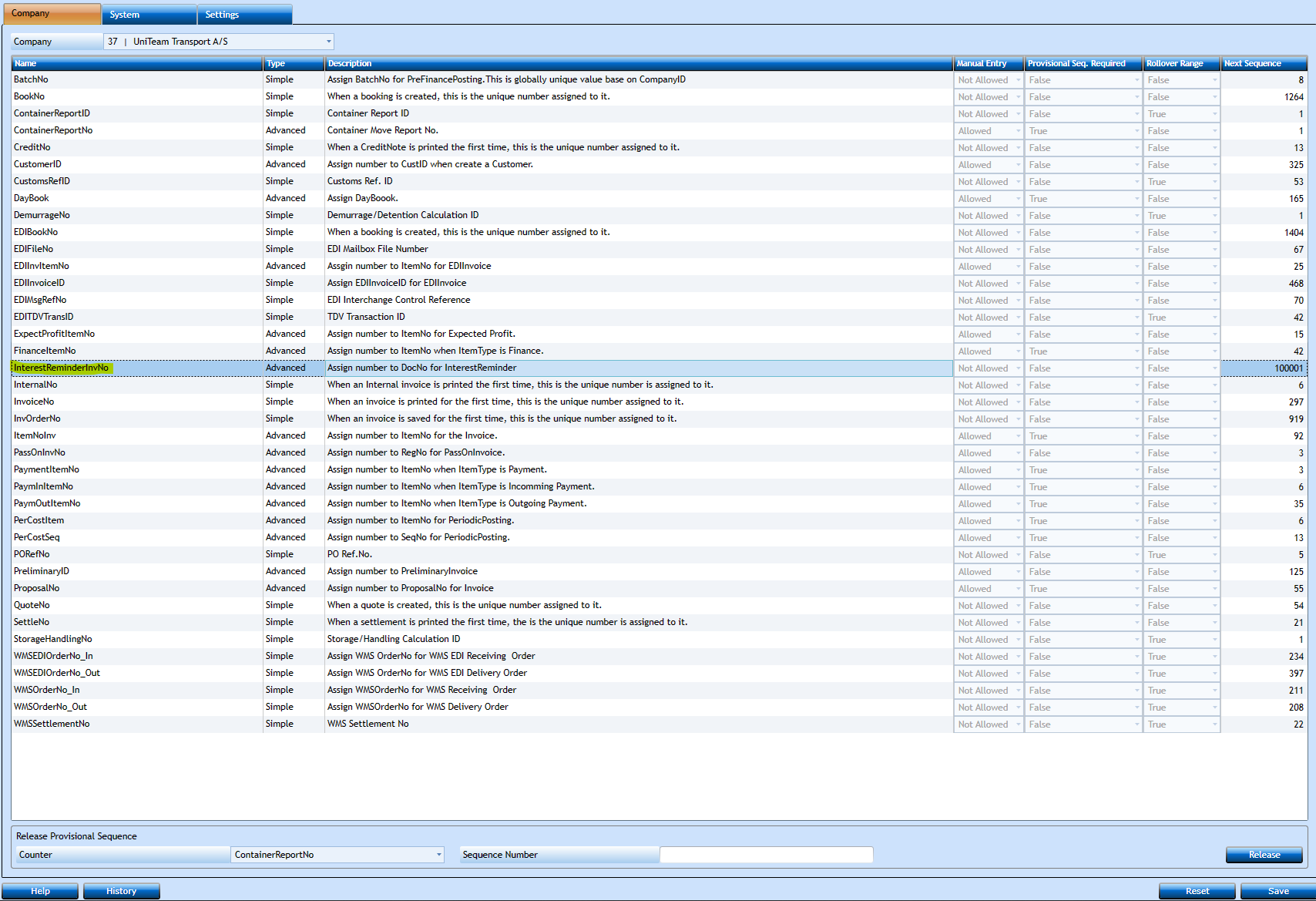

Counter: A counter for the interest invoice numbers is by default setup to start with 1.

Go to Administration / System Configuration /Counters and change the InterestReminderInvNo counter, if you wish to start with a different number.

Calculation:

The calculation itself is accessed via the menu Finance / Posting / Interest Reminder

System will take the defaults from the parameters already entered.

Choose Calculation Type – Remember Open invoices is for Reminders only

You will have to fill in the dates and filter on customers, groups and/or currency.

Press Save to execute calculation. System will inform you when calculation is finished.

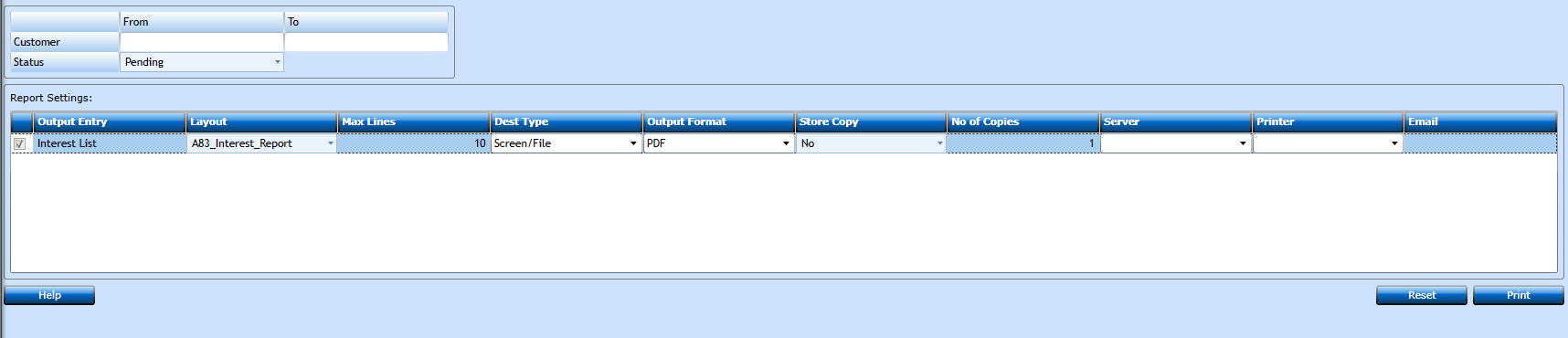

You can print the Interest report to see what has been calculated. This program is accessed from here:

Finance / Report / Interest Report Print

Amendment:

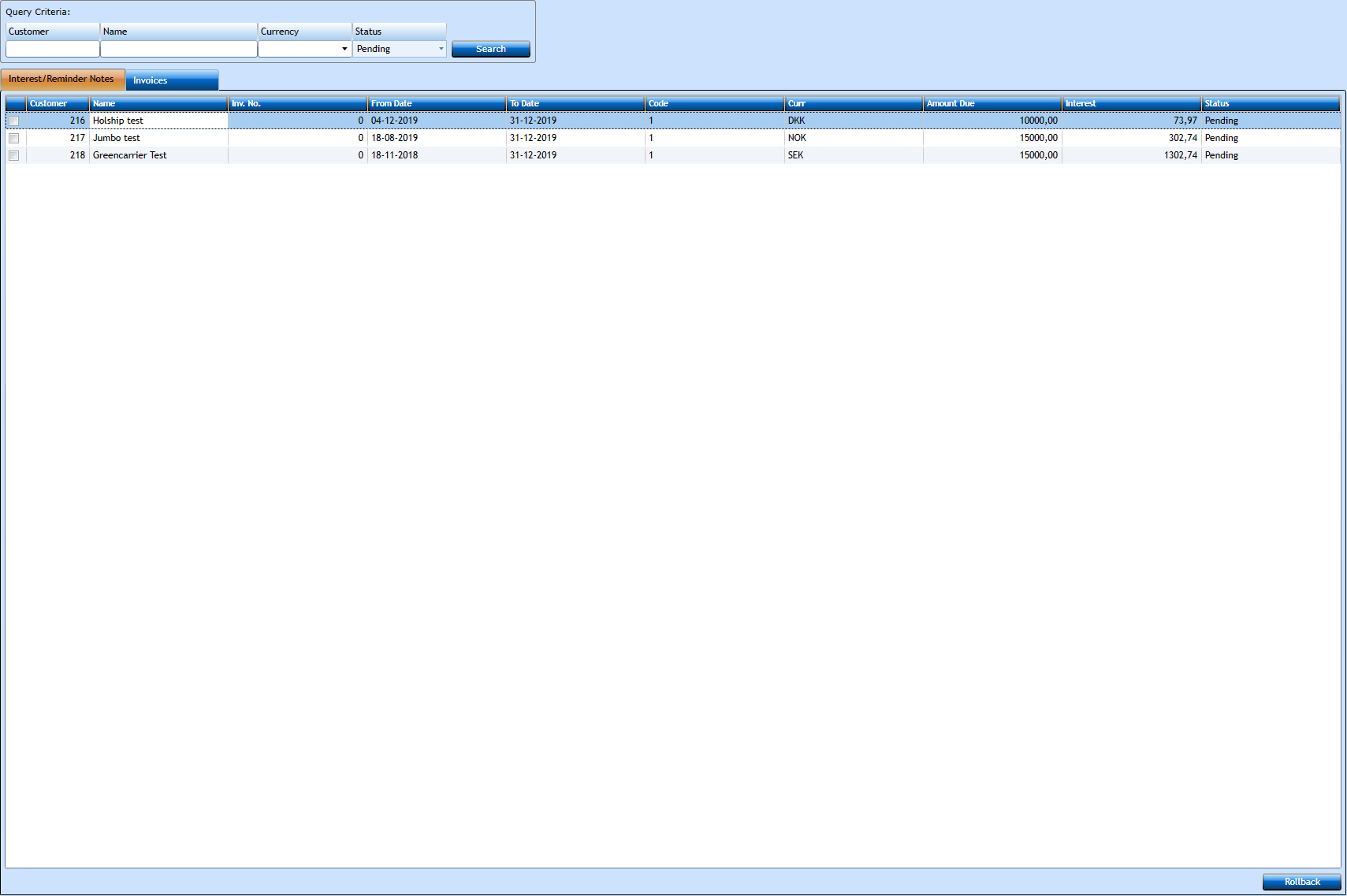

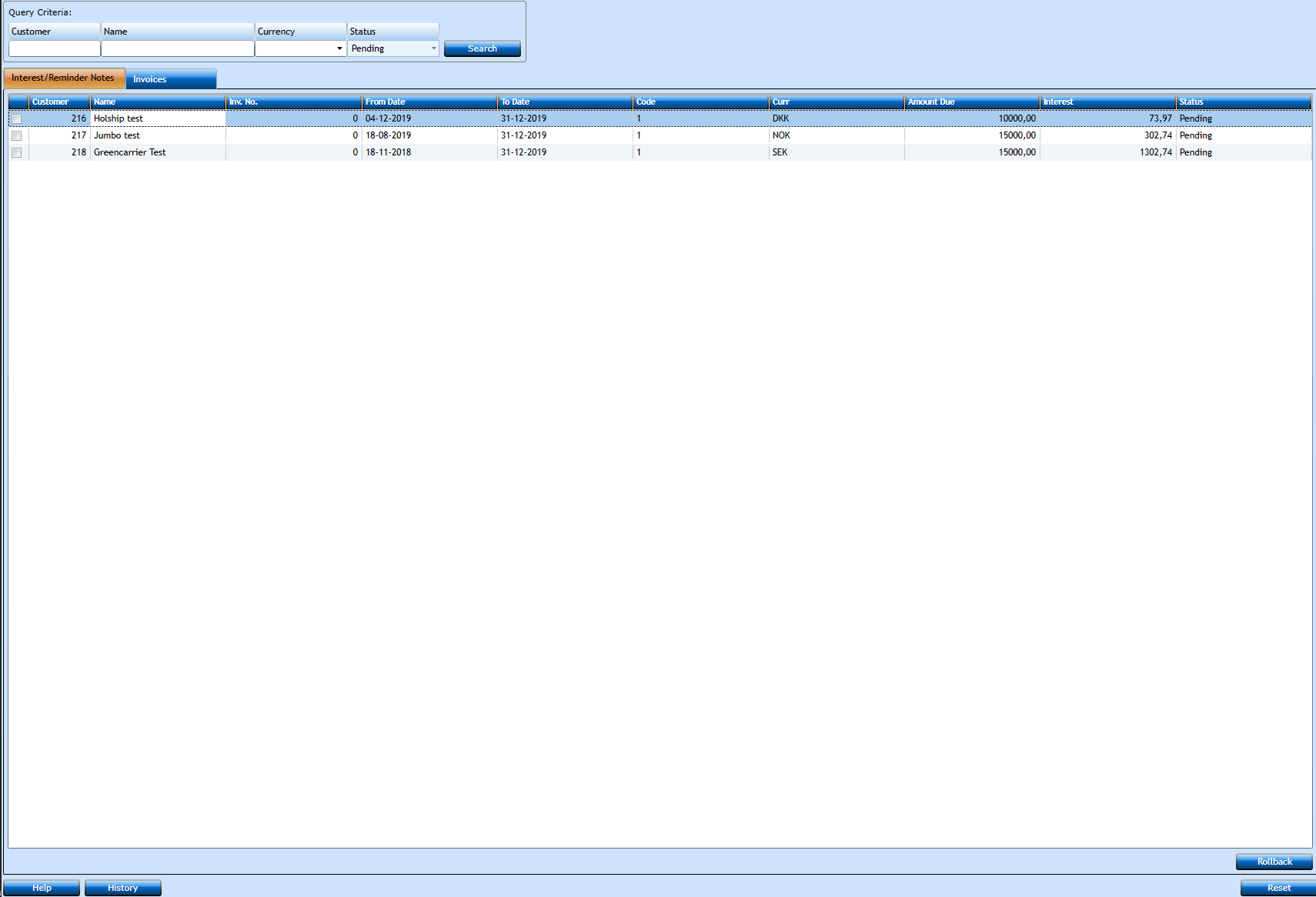

If you need to delete some of the interests go to Amend Interest Reminder via the menu:

Finance / Posting / Amend Interest Reminder

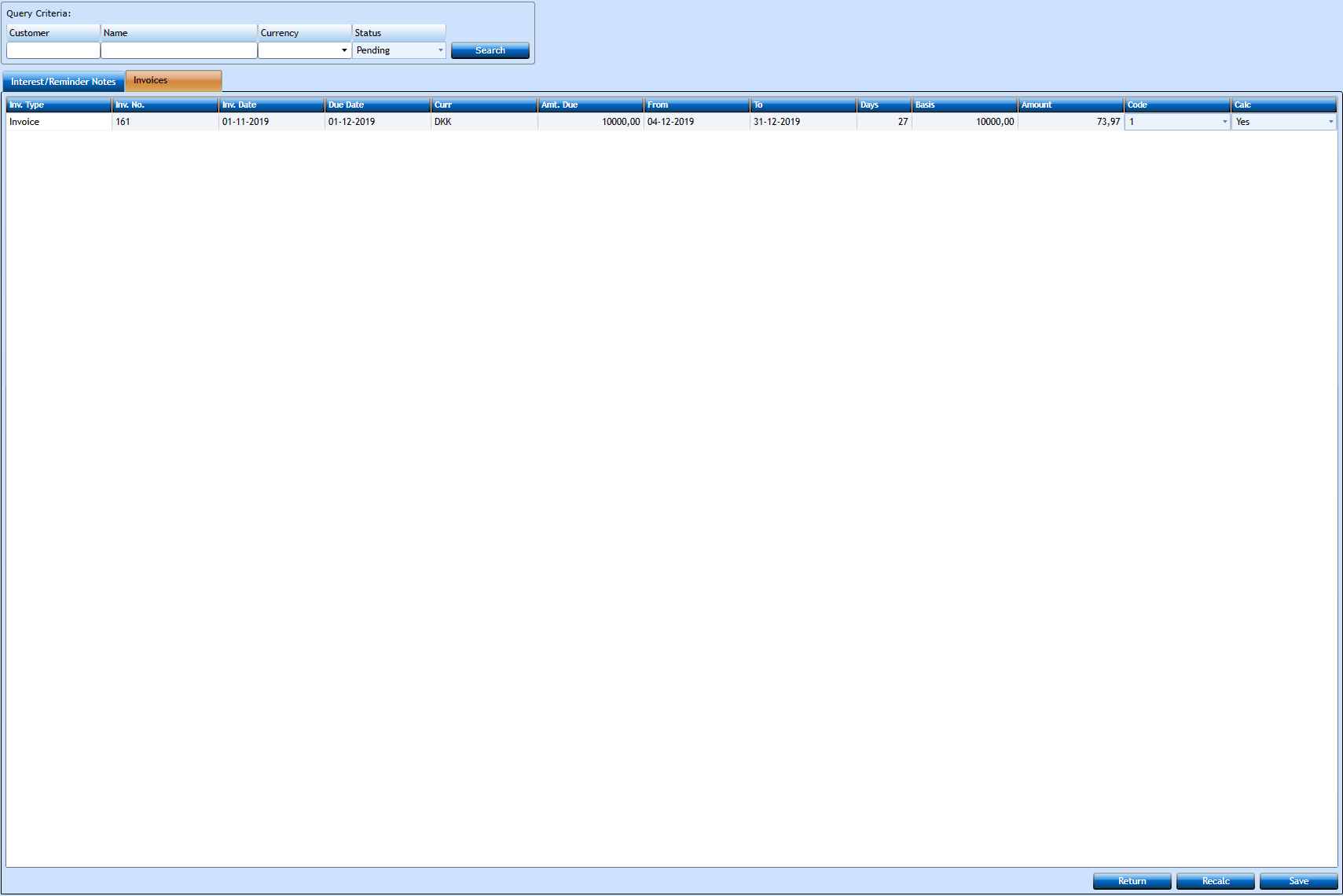

You can insert a specific customer number and press Search. Or you can insert currency and press Search to get calculations in one specific currency. If these fields are left blank before pressing Search, you will get everything. You will see one line per customer per currency. If you mark a line and go to the Invoices tab a list will show you the invoices calculated.

In this screen you can amend specific calculations. If an invoice should not be calculated, change Calc to No and press re-calc.

You can amend the reminder code if the invoice should trigger a different reminder fee.

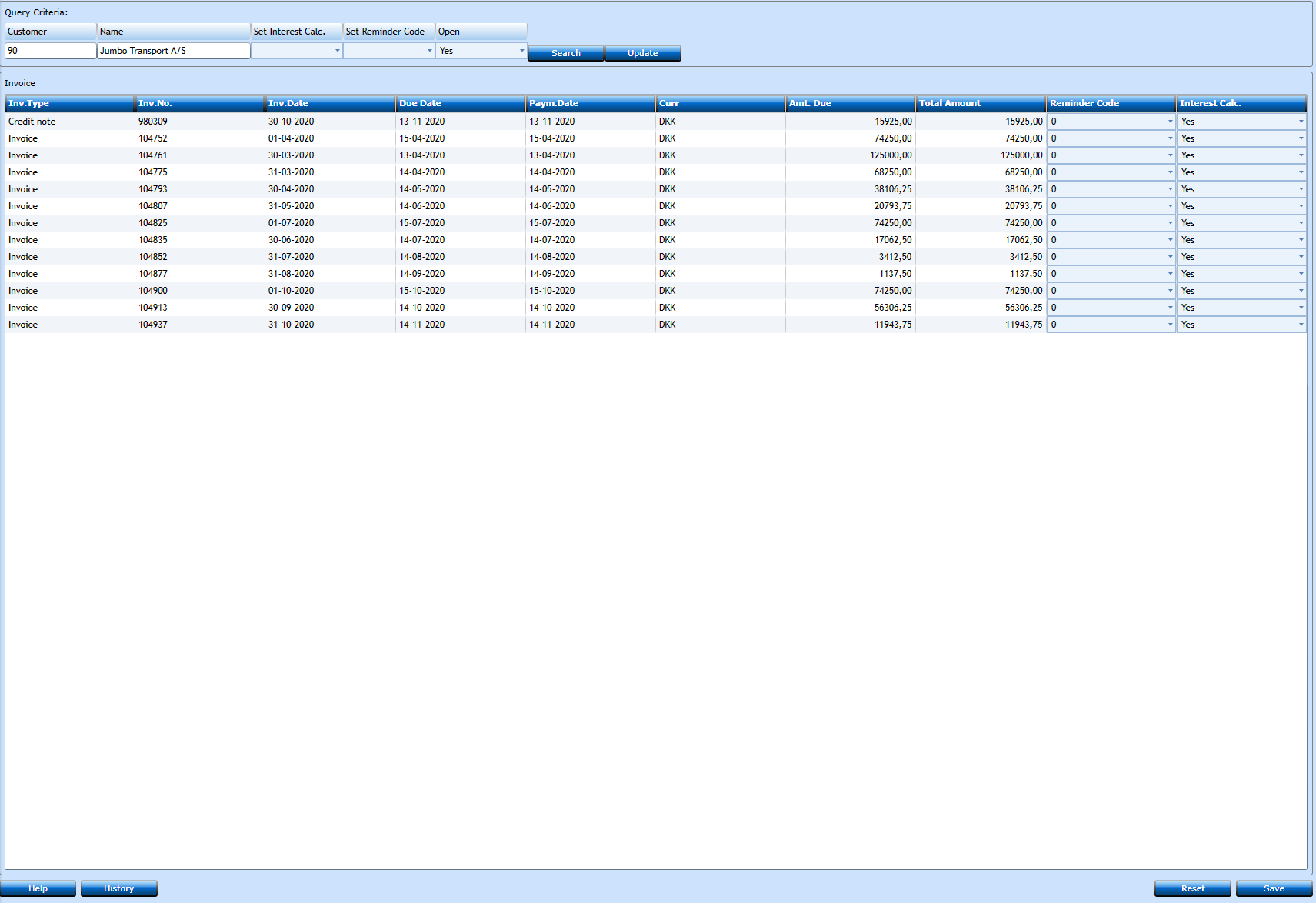

Finance / Posting / Amend Invoice Codes

Here you can change the reminder code, and amend interest calculation to YES or NO for each invoice

Print/Send reminder/interest invoice

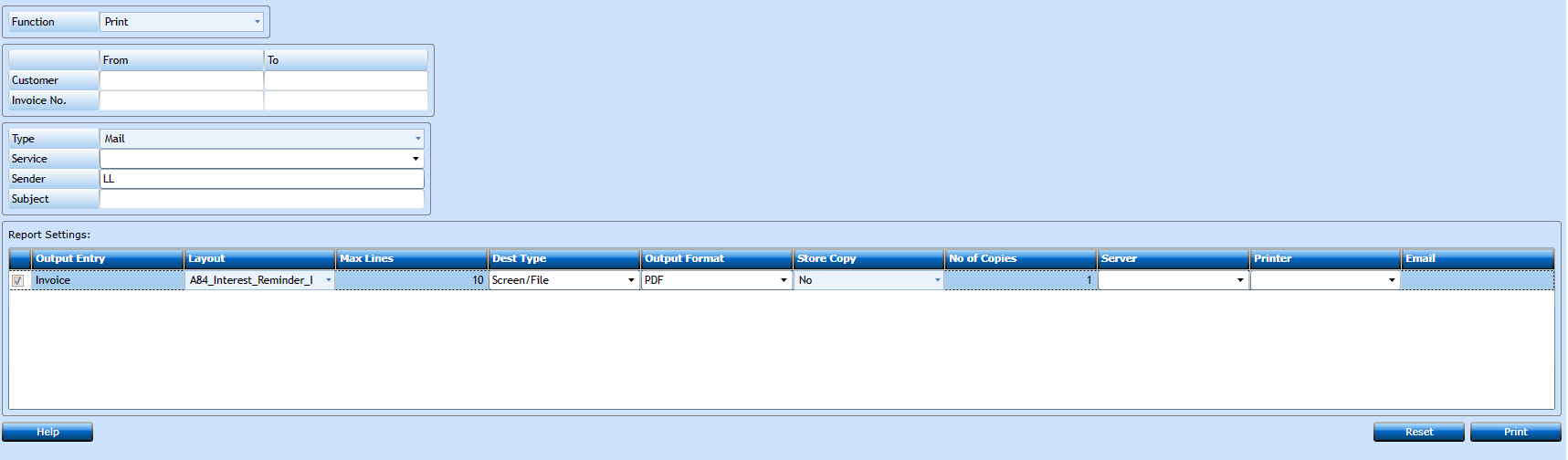

Printing of the invoice is accessed from Finance / Report / Interest Reminder Invoice Print

Choose print and insert from and to customer number.

If the invoices have been printed choose reprint to get a new set. In this case you must insert the invoice numbers.

If you have printed the invoices and then amend the calculation afterwards you have to choose Print again. Not reprint.

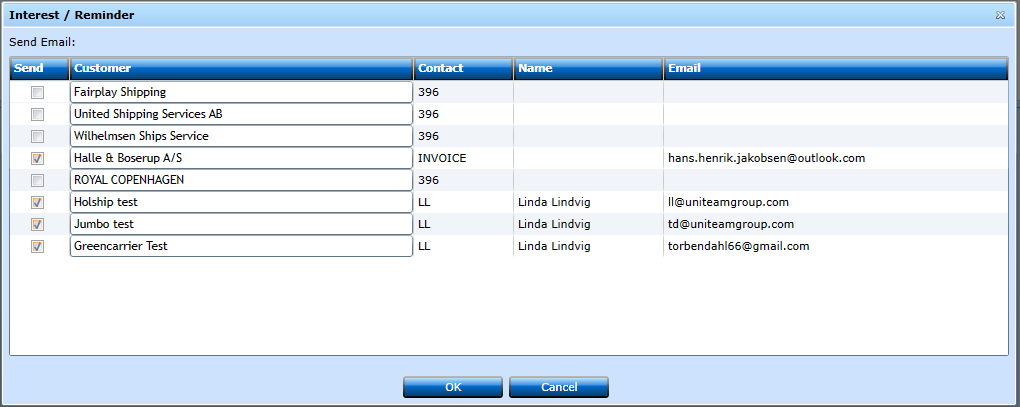

When you choose Mail in Type, remember to insert a Service. After pressing Print a new window will appear, giving you a chance to remove any Customer to do not want to send to.

Posting interests / reminder fees

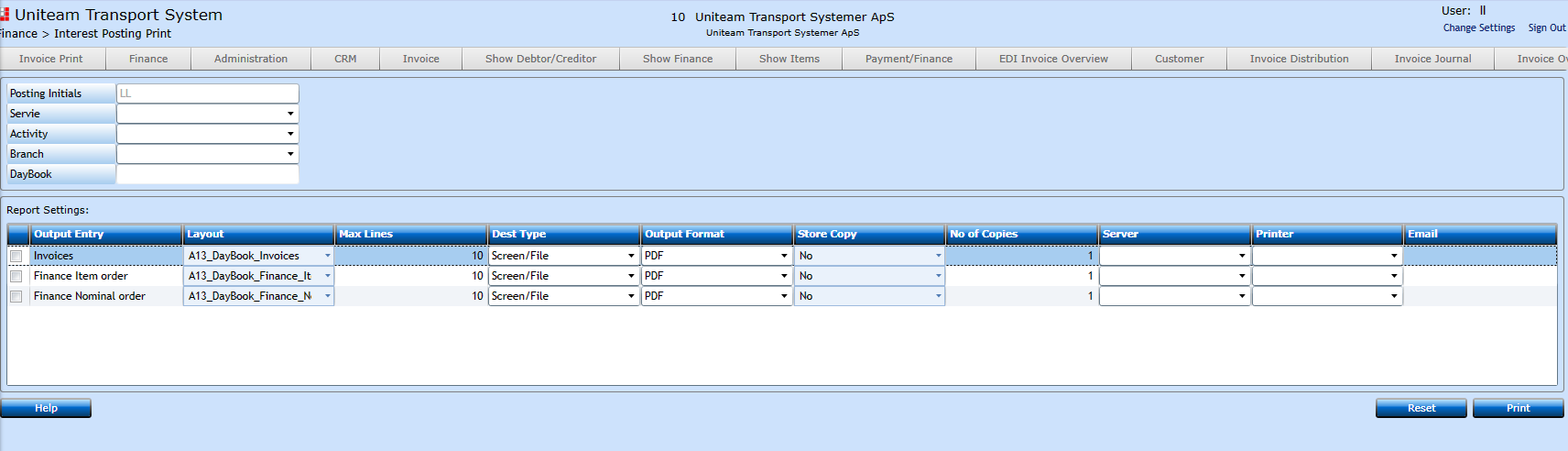

When all invoices are printed you can open the last program - Finance / Reports / Interest Posting Print

System default the initials of the person logged on to Uniteam.

You can add details if these interest invoices should be posted on department (service) or activity or branch.

The print will create a diary for documentation and post the amounts onto debtor control nominal and the preliminary interest nominal.

Rollback

If you have a dispute with a customer who does not want to pay, the system can make an automatic rollback of an interest invoice. It will create a credit and settle these two against each other.

The rollback function is located at Finance / Posting / Amend Interest Reminder

Insert customer number and choose status Posted. Press search and the list of invoices to this customer appear. Mark the one in dispute and press the Rollback button.

Now the invoice will be removed from the list and the credit will settle the invoice.

Payment

When you receive the payment, you settle the invoice same way as you do with regular invoices.

The system will then post from the preliminary nominal to the profit/loss nominal besides posting onto bank and debtor control nominal. Date and period will be date and period of payment.